It’s no secret that America is in the midst of an economic crisis. It’s also commonly known that much of our debt issues arise from our federal government spending our beloved America into oblivion with endless stimulus packages and reckless waste. While Representative Paul Ryan’s budget continues to be hammered by critics and Congressional Democrats continue to stall on presenting a budget of their own, Americans are left to seethe with anger as Congress argues without solutions and endlessly squanders away our tax dollars. One of President Barack Obama’s “solutions” to our economic crisis is to enforce higher taxes on the wealthy, or the top 1% of income earners. Barack Obama not only champions this as a way to fix our debt, but as a way to close the gap of “income inequality”. As someone who admires and supports those who take it upon themselves to work tirelessly to earn their success through income, I find that exorbitant tax increases on the rich are a non-solution and merely create an alluring rhetoric for Barack Obama’s supporters.

The Obama Administration’s contempt for personal wealth through higher taxes on the rich is not only ineffective, but victimizes the prosperity others work hard to achieve. By increasing taxes on the rich the federal government will affect the job market, devalue success, and create a convenient mirage for the American people who believe that higher taxes on the wealthy through the Buffett Rule will somehow magically fix our economy.

One of the biggest issues with taxing the wealthy is the issue of job creation. It’s common sense that if you heavily tax those who create jobs in a weak economy, it will be much harder to hire people, and perhaps cause lay-offs. There are many who say that higher taxes don’t cause enough economic distress for the top 1% to affect job creation, but this simply isn’t true. Do the poor hire people? No. The wealthy do. Debates on raising the taxes of those who earn $250,000/yr continue to rise in Congress, that group of people being comprised mostly of small business owners. In the poor economy we live in today, the last thing we want to do is directly affect job creators with higher tax rates.

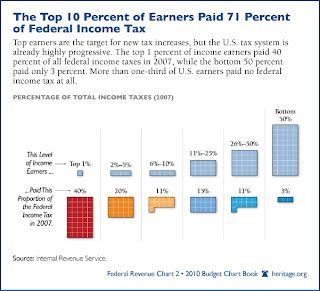

A common fallacy amongst Americans is that the wealthy simply don’t pay their fair share. We’re constantly told that the rich are “evil” and should be paying far more than they do at this time. Little does most of America know that the wealthy actually pay most of the federal income tax in the United States. Data published by the Tax Foundation in 2011 showed that in 2008 the top 1% of income earners (those who made more than $380,000) paid a staggering 38% of all federal income taxes while earning 20% of all income. How much did the bottom 50% (those earning $33,000 or less) pay in 2008? Less than 3% of all federal income taxes. To me, this seems like quite the fair share.

To further promote Obama’s class warfare agenda, he has once again proposed the Buffett Rule: a tax rule stating that those who make $1,000,000 must pay at least 30% of their income in taxes. With the information I just presented, doesn’t it seem a little unnecessary? Furthermore, a study done by Congress’s official tax analysts found that the Buffett rule would only produce a measly $47 billion over 11 years -- only paying for about an hour’s worth of our national debt. In reality, the Buffett Rule would have absolutely no impact on the deficit and is simply another jab at the prosperous. Which is exactly why recently the Senate couldn’t produce enough votes in favor of this rule to send it to the president’s desk. Better luck next time.

What kind of example does this set for younger generations? Ostracizing those who work their way up the ladder of success to ultimately become wealthy? President Obama’s attack on the prosperous devalues success. Look at Occupy Wall Street for example, a bunch of angry college students who show their absolute disdain and hatred for who? A bunch of people who tried and succeeded? Being wealthy is nothing to be ashamed of. I thought that the “American Dream” included being financially stable, what’s so wrong with that? Be wealthy. Be successful. Money isn’t evil, the people who obtain it may be, but that shouldn’t discourage accomplishment.

I’d like to close by saying that while hiking tax rates on the wealthy isn’t the right solution, there needs to be one. Only 53% of Americans pay their taxes, which is an absolutely horrendous number. Loopholes and corruption in our tax code is to blame for this. What I would propose we do is set a flat tax rate for every American, regardless of income, and enforce the payment of that tax. If you really want to encourage fair share, then make everyone pay the same. The bottom 50% pay the same number as the top 1% and vice versa. This is the only way we can truly gain “fairness” in a tax system.

No comments:

Post a Comment